Augmented Reality in Accounting: Revolutionizing Financial Management.

Imagine walking in a park. You see amazing creatures come to life. All of a sudden, your surroundings become a fantastical adventure. This magical experience is possible through Augmented Reality (AR). AR is gaining rapid popularity because it brings the digital world to life in a mesmerizing way.

Just like in other sectors, AR makes it easy to view and interact with data. This is a total game-changer for accounting. Better data visibility and interaction change how we analyze and report financial data in real-time. Hence, it is changing the way professionals connect with data.

Augmented Reality in Accounting makes complex financial data easy to understand. Moreover, it also makes those data more accessible. AR improves data analysis by blending digital information with the real world.

Nowadays, accountants realize the need for skill development. Today, they can review data in incredibly appealing and interactive ways. As a result, decision-making became easier. It also gives an in-depth overview, which increases awareness of financial outcomes. AR technology simplifies operations and reduces errors. Thus, it will help increase productivity and make future economic scenarios and outcomes more natural.

So, if you own an accounting firm or work as an accountant. In that case,

Implementing AR might give your company a significant edge. It could keep you ahead of the competition, especially if you succeed as a pioneer. AR offers new ways to connect virtually with clients, partners, and prospects. Want to know how?

Take a closer look at this article and find out all the fascinating details waiting for you.

Introduction to Augmented Reality in Accounting

Augmented Reality is a fantastic technological tool. It combines interactive 3D computer features with the actual world. For example, you can use your phone to see a dinosaur in your living room. It appears like the dinosaur is really present! Artificial intelligence (AI) scans the natural world with cameras and sensors. The computer then adds digital visuals on top. And the picture you see seems natural to you.

AR is helpful in many areas. It enhances the enjoyment of gaming. It improves student learning. In healthcare, doctors can see inside the body and accurately diagnose conditions.

AR in Accounting

AR is now also helpful with accounting. Accounting focuses mainly on money management. It entails recording, categorizing, and summarizing Financial Transactions. AR allows companies to keep track of their Revenues and Costs. Accountants create financial statements. These statements show the economic health of a company. They also help companies with tax matters. Accountants ensure that companies follow Financial laws and Regulations.

AR in accounting is a natural fit for accounting firms. It systematically organizes your firm’s diverse data. AR technology helps users track information easily and work effectively. You must embed AR in your Accounting Management software to beat competitors. Augmented Reality can improve your accounting and auditing. It can also add a twist to your products and services and boost productivity. AR can record accurate info automatically. As a result, it reduces the time employees spend fixing document errors. And gives them more time to do other things.

The Integration of Augmented Reality in Financial Management

The world of finance is really changing fast these days. AR and accounting are merging in a way that is changing the way we interact with data. This new tech blend equips finance professionals with powerful new tools.

Shifting the Financial Model

Accounting is not just about numbers anymore. Augmented Reality (AR) makes data come to life. Accountants may now view financial models in 3D. This allows them to make better decisions.

- Easily visualize complex data.

- Interact with financial stats in real time.

- Improve accuracy and efficiency.

With AR, you can point a device at a spreadsheet and watch charts appear. It makes comprehending patterns and forecasts easier.

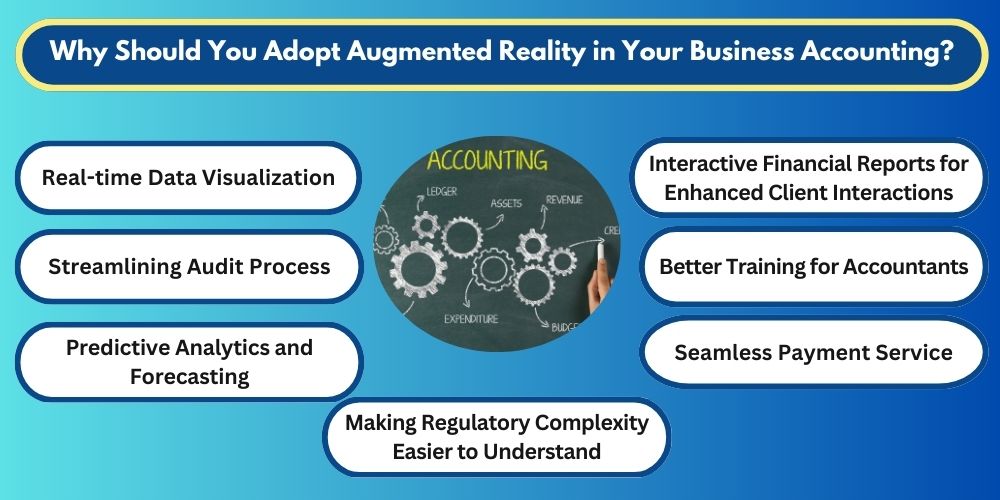

Why you should adopt AR in your Business Accounting?

AR in Financial Management boosts data accuracy, aids decision-making, and simplifies financial analysis. It leads to better business results. Let’s find out the benefits of integrating AR into accounting.

1. Real-time Data Visualization

Understanding financial data can be challenging. AR can help make this task easier. AR can create 3D graphs. These graphs show financial data in a fun way. As a result, spreadsheets are not as dull as they were before. AR has made dashboards interactive using real-time data. Users can click to see more details. You can see real-time updates of financial metrics. Augmented Reality turns data rows into 3D graphs. It helps accountants and clients quickly understand financial data and spot issues. They can then make better business decisions for the future.

2. Interactive Financial Reports for Enhanced Client Interactions

AR technology in financial reporting transforms financial data into visual stories. Which you can easily understand. Client interactions are key in accounting. AR can make these interactions memorable. When you use AR to present financial reports, clients will find them more engaging. Moreover, AR can create virtual meeting spaces. Remote meetings can feel a lot more personal this way.

Also, clients can use AR to interact with proposals. It lets them explore options and see business trends and patterns right away. Thus, this quick understanding helps you and your clients make logical and meaningful decisions. AR provides better analytical skills and allows you to evaluate the company’s performance. Clients feel more connected when using augmented reality. This promotes trust and long-term connections.

3. Streamlining Audit Process

Audits can be stressful and time-consuming. AR has simplified this process. Auditors can now work faster and with better accuracy. This technology is a game-changer in the accounting world. AR brings data to life during on-site audits. It gives dynamic visual reports. Another advantage of AR Audit is Hands-free data access.

Auditors can use smart glasses to review data without laptops or papers. Moreover, AR makes findings more evident. AR can provide checklists that auditors can follow. This ensures nothing is missed. AR can allow team members to collaborate in real-time. This speeds up the audit process. By using AR, audits become smoother. This saves time and reduces errors.

4. Predictive Analytics and Forecasting

Using augmented reality in accounting can help you see what the future of your business might look like. When you collect and analyze past data, you can pinpoint what you should focus on right now. Moreover, you can develop unique financial management strategies for the future. You can dig deeper for any level of detail you want. For example, how long a process will take, employee performance, and changes in customer demand. As a result, you can make better business decisions for the future.

5. Better Training for Accountants

It’s essential to train your staff in accounting. AR can provide more engaging training for accountants. Let me share some benefits with you:

Finance professionals can now enjoy hands-on learning like never before. AR creates real-world scenarios for practice. This gives step-by-step guidance that you can easily follow along and learn quickly. Like, you can practice virtual ledger without real financial risk. It also generates virtual coaches so you can understand the correct methods instantly. Moreover, it supports you when you encounter challenges. As an Accountant, you can learn new skills through AR simulations. These simulations test your knowledge in a fun way. With AR in accounting, learning becomes more effective and adventurous. It also reduces the cost of traditional training methods.

6. Seamless Payment Service:

Integrating the payment interface with AR technology creates a seamless user experience. Using AR in financial services, you can make a virtual shop where consumers can buy goods and services without leaving the virtual world. Users can make payments without interruption, just with a click on their smartphone. Which makes the purchase more convenient and secure.

7. Making Regulatory Complexity Easier to Understand

Accounting regulations can feel pretty dense and tricky to navigate, aren’t they? AR makes this easier for you. Picture yourself aiming your smartphone at a financial document. Right away, AR points out the essential compliance details for you. Interactive guidelines give you advice just when you need it. AR filters through complex documents, helping you find important compliance information quickly. It enables you to lower the chances of making mistakes. With AR, you can handle regulatory demands efficiently as an accountant. You stay updated with changing laws rapidly. Enhanced Transparency in Financial Statements.

Tools Needed for Implementing AR in Financial Management

AR Software

AR software helps create and view augmented reality content. Some popular AR software includes:

- Vuforia: This software is easy to use and highly powerful.

- ARKit: Developed by Apple for iOS devices.

- ARCore: Developed by Google for Android devices.

AR Hardware

AR hardware is necessary to view AR content. Essential hardware includes:

- Smartphones: Most AR apps work on smartphones.

- Tablets: Tablets have more giant screens for better AR experiences.

- AR Glasses: These glasses overlay digital data onto the real world.

Data Visualization Tools

Data visualization tools help to present financial data understandably. Popular tools are:

- Tableau: This tool creates interactive data visualizations.

- Power BI: Microsoft’s tool for business analytics.

- QlikView: This tool helps in data discovery and visualization.

Cloud Storage

Cloud storage is essential for storing large amounts of data. Popular cloud storage options include:

- Google Cloud: Offers scalable storage solutions.

- Amazon Web Services (AWS): Provides secure and reliable storage.

- Microsoft Azure: Another popular cloud storage solution.

Techniques for Implementing AR in Managing Finances:

♦ Data Integration

It’s vital to integrate different data sources. This makes sure that all your financial data is current and correct.

♦ Real-time Data Analysis

AR can help you analyze data in real-time. This can really help you make quick decisions.

♦ Interactive Dashboards

You can use interactive dashboards to engage with financial data. You can do this through touch or gestures.

♦ Training and Development

You need to train employees on how to use AR. This helps you use the tools effectively.

Challenges and Problems of Automation in Financial Management Through AR

Augmented Reality (AR) is changing the way one thinks about accounting. While AR has many benefits, there are also challenges. Here are some challenges of implementing AR in accounting:

♦ Privacy and Security Issues: AR in accounting raises serious privacy and security concerns. AR technology blends digital data with the physical world, creating unique vulnerabilities. You really need to protect your sensitive financial information with data encryptions. Make sure that only authorized users can see the data. Plus, regular audits can help you spot any security flaws early on. You should team up with IT experts to tackle these concerns together.

♦ High Cost

Implementing AR can really add up in costs. You should consider investing in AR technology and training for your firm. But you know, the long-term benefits can really outweigh those initial costs.

♦ Technical Issues

AR technology is still evolving. Some devices might be unable to handle advanced AR features, so you could run into technical issues and glitches. You need to be ready to handle these issues.

♦ Resistance to Change

Embracing change can be challenging but often leads to growth and new opportunities. Some accountants might be hesitant to adopt new technology. You really need to provide proper training and support. This can help you reduce resistance and encourage adoption. Not everyone might feel at ease with using AR technology.

Future Trends in Augmented Reality:

The future of AR in business looks promising. Firms are now investing in AR for growth. They create AR apps for better data interaction. Here are some trends to watch:

- Increased Adoption: More businesses will use AR in their operations.

- Enhanced Technology: AR devices will become more advanced and affordable. Which will make accounting even more manageable.

- Integration with AI: Combining AR with AI will make better apps for data analysis.

- Increased Adoption: More businesses will start using AR in accounting.

These trends will reshape how businesses interact with customers.

Preparing for an Augmented Financial World

The finance sector must get ready for AR. Training programs are crucial. They teach staff about AR benefits.

New job roles appear, like AR financial analysts. Schools now offer AR courses. This prepares future accountants.

Year | AR Impact in Finance |

2025 | AR in most finance firms |

2030 | AR for personal finance management |

Conclusion

Augmented Reality could really change the game for accounting. As you see businesses diving into AR, we can expect more exciting developments ahead. Implementation of AR can enhance data visualization, client presentations, training, auditing, and collaboration. It can also boost customer satisfaction and give your business a competitive edge.

Sure, there are some challenges, but the benefits of AR definitely make it something you should think about. Considering how your accounting firm can incorporate AR into its operations would be best. Embracing AR can help you stay ahead and lead to growth and success in various industries.

Are you ready to explore the world of Augmented Reality? The possibilities are endless!

Frequently Asked Questions

What Is Augmented Reality in Accounting?

Augmented Reality (AR) in Accounting refers to the innovative use of AR technology to enhance financial data visualization and interaction for accountants.

How Does AR Transform Financial Reporting?

AR transforms financial reporting by allowing real-time, interactive 3D visualizations of complex financial data, making it easier for you to analyze and make decisions.

Can AR Improve Accounting Accuracy?

Yes, AR can improve accounting accuracy by providing immersive visualizations that reduce the likelihood of misinterpreting data.

What are the Benefits of AR for Accountants?

The benefits for accountants include enhanced data analysis, interactive reporting, and the ability to visualize financial outcomes more engagingly.

Is AR in Accounting Cost-effective?

Implementing AR can be cost-effective in the long run by streamlining processes and reducing errors, which saves time and resources.

Is AR Expensive to Implement?

The cost of AR can vary. However, many affordable options are available for businesses.

Will AR Replace Traditional Accounting Tools?

AR won’t take the place of traditional tools. Still, it will definitely work alongside them to boost what your current accounting software can do.

How Secure is AR in Handling Financial Data?

It would be best to ensure that AR applications use strong security measures to keep sensitive financial data confidential and intact.

What Skills Are Needed to Use AR in Accounting?

Accountants must develop technical skills in AR software operation and data interpretation within a virtual environment.

Are There AR Applications for Tax Preparation?

There are emerging AR applications designed to assist with tax preparation, providing interactive guides and visual aids for accuracy.

How Does AR Facilitate Financial Planning?

AR facilitates financial planning by allowing planners to model financial scenarios in a virtual space, making it easier to forecast and strategize.

Financial data visualization and interaction for accountants.

Can AR Improve Employee Engagement?

Yes, AR can make tasks more interactive and engaging, boosting employee motivation.

Very good and informative Article.

Impressive and engaging content. Thank you.

Excelent.

Excellent! Good job

Interesting and engaging. Your insights are spot-on.

Fantastic read! Your expertise really shines through.

This blog is eye-opening! It explains how augmented reality is bringing innovation to accounting in a way that’s easy to understand. From improving data visualization to simplifying complex tasks, the possibilities are exciting. If you’re curious about the future of accounting, this blog is definitely worth reading. Highly recommend it.

Nice writing.